Bond rate of return formula

Rate of Return Formula A simple rate of return is calculated by subtracting the initial value of the investment from its current value and then dividing it by the initial value. 10 shares x 20 200 Cost of purchasing 10 shares Plug all the numbers into the rate of return formula.

Bond Yield Formula Calculator Example With Excel Template

Coupon Rate 6.

. You can find this data. IRR internal rate of return t period from 0 to last period -or- 0 initial outlay 1 CF1 1 IRR1 CF2 1 IRR2. The expected return on a bond can be expressed with this formula.

The RRR can be used to. The value of the perpetual bond is the discounted sum of the infinite series. The discount rate depends upon.

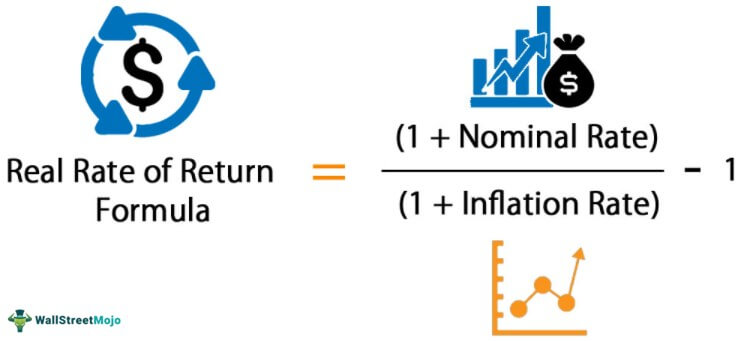

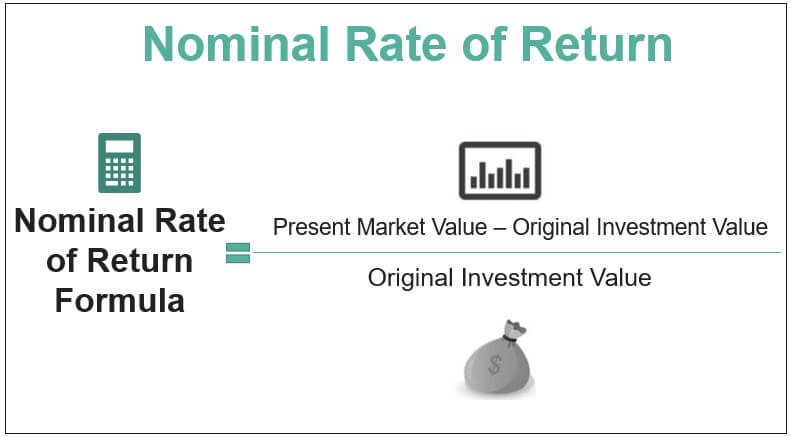

In our example that would be one plus 7 percent or 107. The required rate of return RRR is the minimum amount an investor or company seeks or will receive when they embark on an investment or project. Determine your nominal rate of return and add one to the percentage.

Therefore the investor earned an annual return at the rate of 160 over the five-year holding period. RET e F-PP Where RET e is the expected rate of return F the bonds face or par value and P the bonds. Market rate of return 8 Below is data for the calculation of a required rate of return of the stock-based.

Suppose a bond has a face value of 1300. And the interest promised to pay coupon rated is 6. Face Value 1300.

CFX 1 IRRX Using the above examples. Find the bond yield if the bond price is 1600. Let us take the example of Dan who invested.

I Required rate of return. Annual Return Formula Example 2. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t.

250 20 200 200 x 100 35 Therefore Adam. Of Years to Maturity On the other hand the term current yield. Ad Use Our Simple Tools To Create Your Bond Strategy.

Determine the inflation rate for the year. Therefore the required return of the stock can be calculated as Required return. To get the actual rate of interest sometimes referred to as the composite or earnings rate we combine the fixed rate and the inflation rate using the equation in the example below.

The formula for calculation of value of such bonds is. If youve held a bond over a long period of time you might want to calculate its annual percent return or the percent return divided by the number of years youve held the.

Coupon Rate Formula Calculator Excel Template

Real Rate Of Return Definition Formula How To Calculate

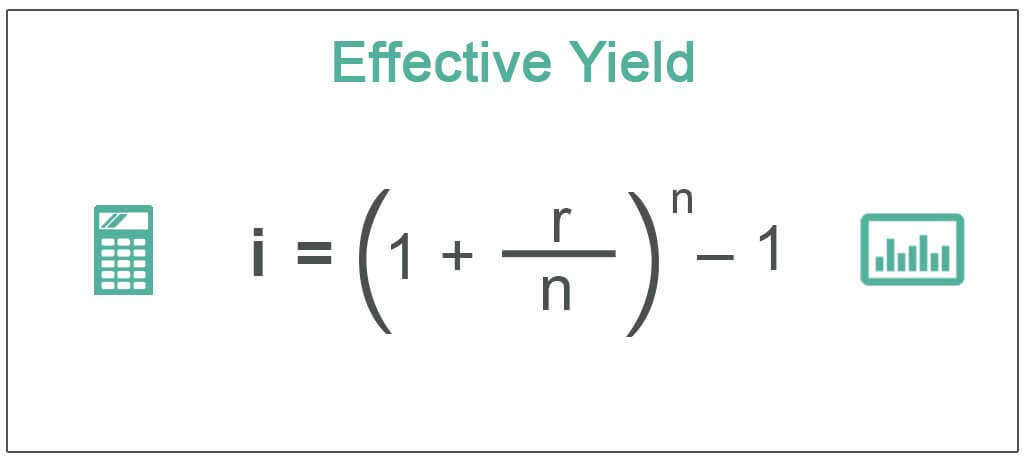

Effective Yield Definition Formula How To Calculate

Zero Coupon Bond Yield Formula With Calculator

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Yield To Maturity Approximate Formula With Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Formula And Calculator Excel Template

Bond Yield Calculator

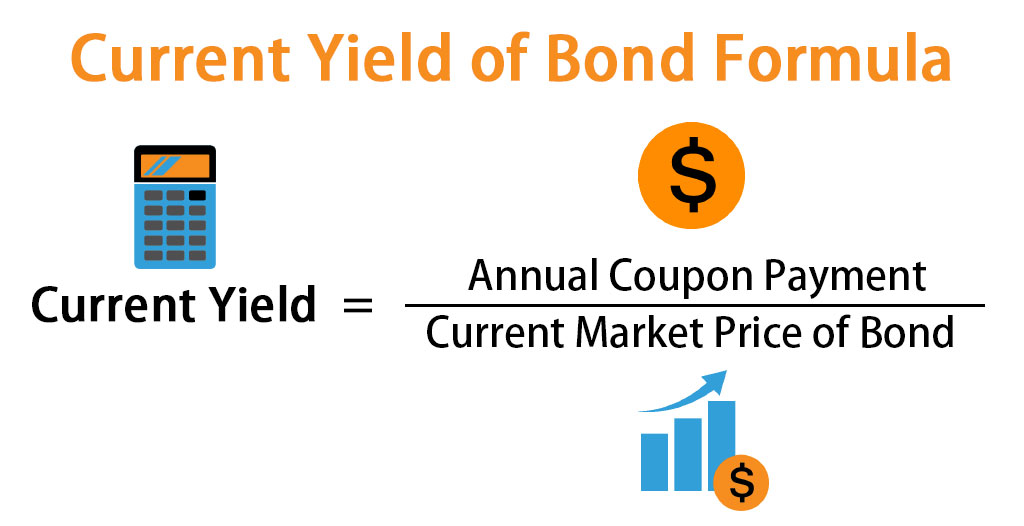

Current Yield Formula Calculator Examples With Excel Template

Nominal Rate Of Return Definition Formula Examples Calculations

Bond Yield Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Ytm Formula And Calculator Excel Template

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Current Yield Bond Formula And Calculator Excel Template