9+ an fha insured loan in the amount of 57500

An FHA-insured loan in the amount of 57500 at a 6 ½ interest rate for 30 years was closed on March 17. An FHA-insured loan in the amount of 157500 at 55 for 30 years closed on July 17.

Chapter 56 The Fha Insured Home Mortgage Flashcards Quizlet

Get Started Now With Quicken Loans.

. FHA loans are mortgages insured by the Federal Housing Administration the largest mortgage insurer in the world. An FHA-insured loan in the amount of 57500 at a 6 ½ interest rate for 30 years was closed on March 17. If the interest is paid monthly in.

Sun January 2 2022. The first monthly payment is due on September 1. FHA Loan Calculator - FHA streamlined loan amount calculator.

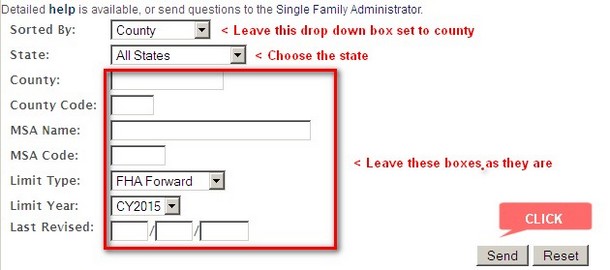

FHA Loan Limits By State for 2022. About 2-5 percent of the loan amount depending on your home price and lender. The first monthly payment is not due until May 1.

Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Since October 4 2010 FHA has required a 10 down payment from borrowers with credit. If the interest is paid monthly in.

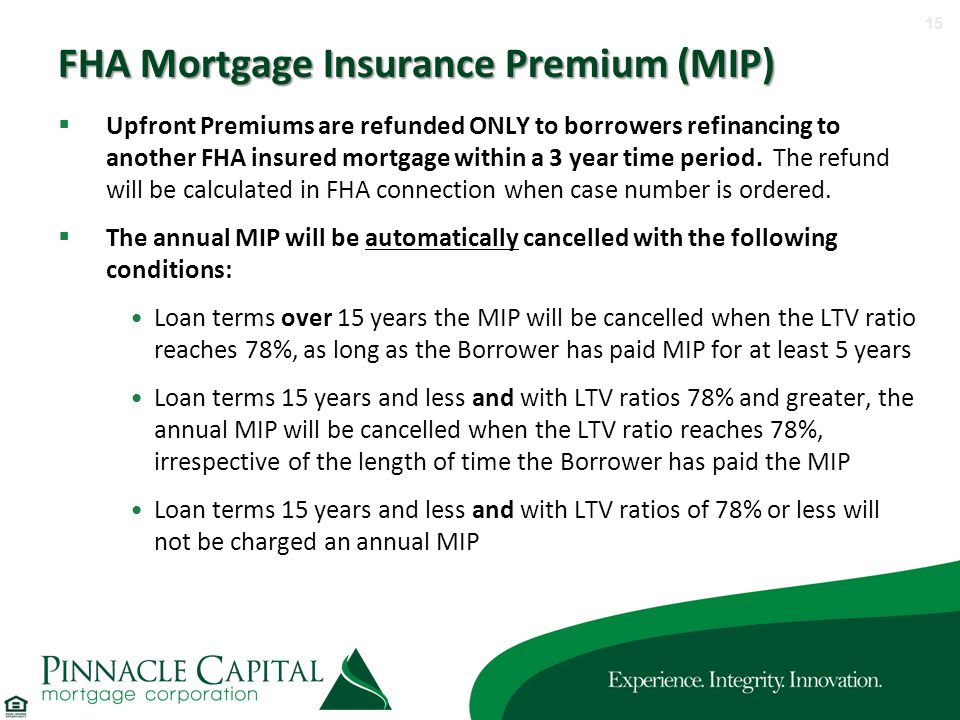

The first monthly payment is not due until May 1. FHA also charges an upfront mortgage. The first monthly payment is due on September 1.

Ad Calculate Your Payment Fees More with a FHA Home Loan Expert. You answered correctly 9 of 50. Based on area loan limit.

FHA loan closing costs are close to conventional closing costs. An FHA-insured loan in the amount of 157500 at 55 for 30 years closed on July 17. Apply Now With Quicken Loans.

The first monthly payment is not due until May 1. FHA-Insured Home Loans. Lowest Loan Limit 809150 Highest Loan Limit 1867275 Lowest limit for homes with four living-units.

An FHA loan is a government-backed loan insured by the Federal Housing Administration. Scores between 500 and 579 while borrowers. An FHA-insured loan in the amount of 57500 at a 6 ½ interest rate for 30 years was closed on March 17.

The Basic FHA Insured Home Mortgage program can help individuals buy a single family home through a loan. You answered correctly 10 of 50 - An FHA-insured loan in the amount of 57500 at a 6 ½ interest rate for 30 years was closed on March 17. Using a 360-day year and assuming that.

Using a 360-day year - 17230711. Compare Mortgage Options Calculate Payments. Find A Lender That Offers Great Service.

Because 9 units x 14800 per. Ad Compare Mortgage Options Get Quotes. Compare More Than Just Rates.

See How Much You Can Save with Low Money Down Low Interest Rates. Essentially the federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments. Means a home equity loan that has been or is being reported to the Federal Housing Administration or any successor thereto FHA as eligible for credit.

Fha Mortgage Rates Best Fha Home Loan Rates Programs

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Homebuyer Loan Programs For Fha Va Khc And Usda Mortgage Loans In Kentucky

Tucson Daily Citizen From Tucson Arizona On October 12 1973 Page 47

Fha Mortgage Insurance Calculator Anytime Estimate

Fha Loans Everything You Need To Know

Times Leader Homes Luzerne Edition 08 08 2012 By The Wilkes Barre Publishing Company Issuu

15 Best Fha Mortgage Ideas Fha Mortgage Mortgage Mortgage Loans

Fha Loan Requirements In 2022

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Fha Loan Requirements In 2022

Fha Loan Mip Calculator Estimate Additional Loan Payment Costs Moneygeek

Usda Vs Fha Which Loan Is Better For First Time Home Buyers

1222 S Sunnyvale Mesa Az 85206 Mls 6459402 Redfin

Qq Teche 02 19 15 By Part Of The Usa Today Network Issuu

Meet Our De Underwriters Ppt Download

Fha Home Loan Calculator How Much Can I Afford

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information